【Case Study】Relationship between a spouse visa and income

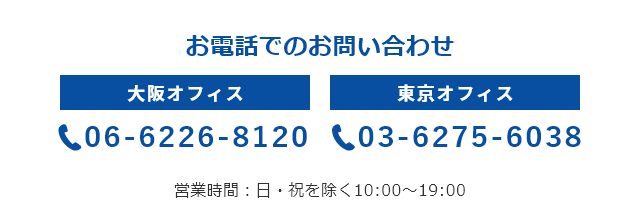

Ms. C, a Chinese female, and Mr. J, a Japanese male who had been seconded to China for many years, met in China, fell passionately in love, and got married. Marriage was successfully formed in both Japan and China, and they were living in China, but Mr. J received a letter of appointment from his company, which ordered him to go back to Japan.

Mr. J decided to take Ms. C to Japan, and for that, he conducted some research to find out about spouse visas.

Then, he managed to find that there was a status of residence of “Spouse or Child of Japanese National” (hereinafter referred to as a “spouse visa”), but he got shocked when he saw the list of documents required to apply for a spouse visa. He checked the website of the Immigration Services Agency and found that the required documents included “certificate of taxation (or tax exemption) of residence tax and certificate of tax payment (that describes the total income and tax payment status for 1 year) of the Japanese spouse. 1 copy each.”

Mr. J had removed his resident card because he had been seconded to China for many years. Consequently, as he paid no residence tax in Japan, he could not prepare income certificate or tax payment certificate. Mr. J felt he was in trouble and came to us for consultation.

In this article, we will verify the case example in relation to the relationship between spouse visas and income.

Index

1. Reason for reporting income to an immigration office for a spouse visa application

Why do applicants have to report their income to immigration offices when applying for a spouse visa?

In the examination concerning spouse visas, 2 points are emphasized: (1) whether the couple have a stable financial foundation to live in Japan, and (2) whether the marriage is a genuine marriage.

Income tax certificates and tax payment certificates are required as supporting materials for (1) above.

If applicants do not have stable income, such facts are considered negatively in examination concerning spouse visas. If applicants have not fulfilled tax obligations, such fact is also considered negatively in examination as the immigration authorities are not able to expect them to have a stable life.

2. What does “financial foundation” mean, which is required for acquirement of a spouse visa?

We explained that a married couple need to have a stable financial foundation to live in Japan. What does “financial foundation” mean in the first place?

The most typical example of stable income is monthly salary. For comparison, what if a couple don’t have a stable income but have a fair amount of personal assets?

There is a couple who are unemployed and have no income but have savings of 10 million yen. There is another couple who have a stable income of 200,000 yen per month but have no savings. Which couple are more financially stable?

The answer is the latter couple. It is much easier for the latter couple to get a spouse visa than the former couple.

This is because cash has a high degree of liquidity, so even if the couple have deposits and savings at the time of applying for a spouse visa, they may lose financial foundation afterwards depending on the subsequent circumstances. Besides, in the past, there were fraudulent cases where applicants temporarily borrow money and put them in their bank account to make it look like they have enough assets. For these reasons, the credibility of deposits and savings is considered not high.

Please note that in the current immigration practice, just because you have a lot of deposits and savings does not mean that you can get a spouse visa.

3. Is a spouse visa not granted without financial foundation?

So, if you don’t have enough income, you will not be granted a spouse visa because you don’t have a financial foundation. Is that true?

The answer is no.

Spouse visas can be granted even if you do not have sufficient stable income.

Even without sufficient financial foundation, a spouse visa may be granted if there are other factors that can support a stable marriage in Japan. For example, if your Japanese spouse’s parents run a company and will support your marriage life, you may be granted a spouse visa even if the Japanese spouse’s income is insufficient.

Therefore, it is not “No stable income=Non-permission of a spouse visa.” For the successful spouse visa application, it is important to pick up facts showing the financial foundation sufficient to maintain and continue the marriage life, and to prove them.

4. Importance of income tax returns that can be a reason for not granting spouse visas

If you are a sole proprietor or have an income source other than salary income, you must file a tax return every year. Many people may find it a tedious task, but, if you file a tax return in an improper manner, you may not be granted a spouse visa, or face problems when extending your spouse visa, or end up getting rejection for a permanent resident visa.

For example, if the spouse deduction is not done while the spouse has declared that he/she is unemployed, the immigration authorities may suspect that the spouse actually lives alone and works. In other words, it becomes a factor to suspect the substance of the marriage.

Some people may think there will be no problem because they pay more taxes than what they should pay. However, please note that, even in such case, if spouse deduction is not done, such fact may lead uncertainty of the result of examination, although the spouse deduction seems to be unrelated to immigration examination at first glance.

Another problem with extending a spouse’s visa occurs when a spouse is counted as a dependent while the husband and wife both work full-time, or when a child is counted as a dependent by both parents. There are some cases where these facts become grounds for non-permission of extension of a spouse visa or non-permission of permanent residence.

Income tax returns are very important for spouse visas; therefore, when you declare your income, please make sure that there are no mistakes. In addition, if you made an incorrect declaration, it is important to submit the correct information to the immigration office by making an amended return, etc.

5. Summary of the relationship between spouse visas and income

This time, we have seen the relationship between spouse visas and income.

The examination at the Immigration Services Agency is a document-based examination. Therefore, in order to clarify the financial foundation, it is necessary to prove in documents that your income is sufficient to lead a stable marriage life.

The burden of proof concerning the documents to be submitted to the relevant immigration office lies with applicants. In other words, applicants need to prove by themselves that they can continue to have a stable marriage life in Japan.

If you can prove that your income is sufficient by submitting your income tax certificate and tax payment certificate, there may be no problem. On the other hand, when 2 young people are internationally married and apply for a spouse visa, there are some cases where their income is not sufficient.

If your income is insufficient, you must prepare a document certifying other factors that will support the stability and continuity of your marriage life, and must also think of a strategy on how to apply for a spouse visa.

In this case, Mr. J was seconded to China and could not obtain an income tax certificate. Therefore, we prepared a certificate showing expected amount of salary paid after returning to Japan as well as a certificate of employment.

As a result, Ms. C was able to successfully obtain a spouse visa.

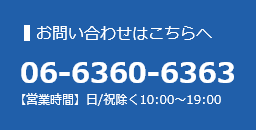

Please do not give up just because your income is not enough, and feel free to contact us if you have any problems.