How foreigners can establish a company in Japan

If foreign entrepreneurs try to start a business in Japan, most of them choose a company, not a private business.

However, foreign entrepreneurs have different challenges from the case of Japanese entrepreneurs, not only in visa issues, but also in the conditions of establishing a company and necessary documents.

Therefore, in this column, we will explain useful information for foreign entrepreneurs to establish a company.

Index

1. The difference between a stock company which is popular with foreigners in the establishment of a company and a limited liability company

If a foreigner establishes a company in Japan, many people will imagine a stock company.

In fact, there are more than 100 types of corporations in Japan.

However, from the difficulty level of establishing a company and the operation after the company establishment, many people choose a stock company or a limited liability company.

Therefore, this chapter will explain the differences between the stock company and the limited liability company.

First, see the table below.

| The stock company | The limited liability company | |

| Registration license tax for the company established | 7/1000 of the capital amount (150,000 yen if it is less than 150,000 yen) |

7/1000 of the capital amount (If it is less than 60,000 yen, 60,000 yen) |

| Articles of incorporation at the time of company establishment | Required | NOT required |

| Minimum capital amount | 1 yen or more | 1 yen or more |

| Designation of payment handling institution | Required | NOT required |

| Investor status | The founder becomes a shareholder according to the amount of investment You don’t have to be a manager |

All investors become managers |

| Representative | CEO | Representative employee |

| Voting right | One share one voting right | One person and one voting right |

| Social recognition | High | Lower than the stock company |

Below, we will explain important differences between the stock and limited liability companies.

When establishing a company, the articles of incorporation must be created.

The articles of incorporation refer to the fundamental rules and rules of the corporation.

When establishing a stock company, being certified by the notary office will cause legal effects on the created articles of incorporation.

By the way, the authentication cost by the notary public is 30,000 to 50,000 yen.

On the other hand, when establishing a limited liability company, it is necessary to create the articles of incorporation, but no certification at the notary public office is required.

A company can be established with capital of 1 yen or more, but if a foreign entrepreneur aims to get a Business Management visa, the capital is a very important issue.

For details, please refer to the concept of 5 million yen in the capital Business Manager visa.

In the beginning of a limited liability company form started, when foreigners established a company in Japan, it was often the case that the limited liability company was shunned because of the inferior social recognition compared to a stock company.

However, the famous Apple Japan and Amazon Japan are also a limited liability company, so the recognition is rapidly increase.

Therefore, in the selection of the stock company and the limited liability company, it is recommended that you consider the type of corporate established in consideration of future institutional design, rather than judging only by social recognition.

In addition, there is a difference for retirement method between the (representative) Director of the stock company and the (representative) Employee of the limited liability company.

It’s a bit difficult, so at the stage of selecting the establishment of a stock company and the establishment of a limited liability company, there is no problem with the understanding that the directors of the stock company are easier to retire than the limited liability company employees.

2. Flow for foreigners to establish a company in Japan

In this chapter, we will explain the general flow of procedures for foreigners to establish a stock company or a limited liability company in Japan.

(1) Determination of basic matters and preparation of the articles of incorporation

A person who invests (pays money) in a company to establish a company is called a founder.

The founder can be one or more.

The founder decides the basic matters of the company to be established, such as the form of the company, the company’s trade name, the location of the head office, the purpose of the business, and the amount of capital.

Then, based on the matters decided by the founder, the articles of incorporation are prepared.

(2) Notarization of the articles of incorporation by a notary public

When establishing a stock company, it is necessary to have the articles of incorporation prepared in (1) certified by a notary public.

On the other hand, in the case of establishment of a limited liability company, notarization of the articles of incorporation by a notary public is not required.

(3) Payment of investment

You need money to run your company.

In the case of establishment of a stock company, it is necessary to pay the capital contribution by the funder to the bank account designated by the funder.

On the other hand, regarding the payment of the investment in the case of establishment of a limited liability company, in addition to the method of paying into the bank account specified by the funder, the method of receiving the investment from the funder and preparing a receipt by the representative employee is also permitted.

(4) Registration of the company establishment

After preparing the necessary documents, apply for registration of company establishment at the Legal Affairs Bureau that has jurisdiction over the location of the head office (the address of the company).

By registering this company establishment, the company becomes legally established.

Depending on how busy the Legal Affairs Bureau is, it takes about a week to 10 days to complete the registration of the company establishment.

① Necessary documents for company establishment

I hope that you have understood the basic flow of the company establishment.

Next, let’s take a look at the documents required to establish a company.

Although it may differ slightly depending on the composition of officers and institutions of the company to be established, there is no problem with the recognition that the following documents are basically required.

The main required documents for establishment of a stock company are as follows.

2 Articles of incorporation

3 Seal registration form (and representative director’s seal registration certificate)

4 Document certifying that the investment has been paid (*1)

5 Funder’s seal registration certificate (*2)

6 Consent letter of appointment of officer (CEO of EX)

7 Officer’s seal registration certificate

*1 It is common to attach the certificate of payment prepared by the representative director and the record of the bankbook in which the investment was paid.

*2 Required to have the articles of incorporation notarized at a notary public office.

The main required documents for establishing a limited liability company are as follows.

2 Articles of Incorporation

3 Seal registration form (and representative employee’s seal registration certificate)

4 Document certifying that the investment has been paid (*3)

5 Consent letter of appointment of the representative employee

*3 Unlike a stock company, a receipt for the investment made by the representative employee is also acceptable.

3. Q&A when foreigners establish a company in Japan

Please see below for frequent questions when foreigners establish a company in Japan.

① What are the advantages of establishing a company?

When starting a business, many people may be wondering whether to establish a company or proceed as a private business.

Setting up a company and running a sole proprietorship differ in terms of initial costs, taxation, social credibility, etc.

| Company establishment (ex Co., Ltd., limited liability company) | Sole proprietorship | |

| Initial cost | Capital, registration and license tax, revenue stamp fee, etc. | 0 yen (only notification of opening of business) |

| Tax system | Corporate tax (15% to 23.20%) | Income tax (5% to 45%) |

| Social credibility | High | Low |

In this way, in the case of company establishment, although social credibility is high, initial costs are incurred.

On the other hand, in the case of a sole proprietorship, although social credibility is lower than in the case of company establishment, there is no initial cost.

As for tax, if the business scale is small, the tax saving effect of sole proprietorship is higher, and if the business scale is large, the tax saving effect of establishing a company is higher.

About 7 million to 8 million yen in income (sales – expenses – deductions) is considered to be the turning point (so-called turning point of incorporation).

There are no restrictions on activities in Japan for foreign nationals who have obtained the status of residence of “Spouse or Child of Japanese National”, “Long Term Resident”, “Permanent Resident” or “Spouse or Child of Permanent Resident”. , Just like Japanese people, it is possible to choose whether to establish a company or a private business, focusing only on the above differences.

However, when foreigners with other statuses of residence or foreigners living abroad apply for a Business Manager visa, most of them choose to establish a company rather than a private business.

The reason for this is that obtaining a Business Manager visa as a sole proprietorship takes more time and effort than establishing a company in terms of proof of business scale.

For details, please refer to How to Acquire a Business Manager Visa as a Sole Proprietorship.

② Can’t you establish a company unless you are in Japan?

In fact, the explanations regarding company establishment so far applies even if the person establishing the company is Japanese.

Problems specific to foreigners arise when the foreigner who establishes the company is not in Japan.

First, let’s take a look at the bank account that can be used to pay the investment (= bank account recognized as a payment handling institution).

〇 Japan domestic branch of a domestic bank (for example, the Osaka branch of the Bank of Tokyo)

〇 Overseas branches of domestic banks (excluding local subsidiaries) (e.g. Beijing branch of the Bank of Tokyo)

〇 Japanese branches of foreign banks (e.g. Tokyo branch of Beijing Bank)

✕ Overseas branches of foreign banks (e.g. Boston branch of Beijing Bank)

In this way, there are multiple options for the bank account to pay the investment at the time of company establishment.

However, a domestic bank account in an overseas branch can only be created by a large company, so a bank account in Japan is usually required.

In addition, many banks require that you have an address in Japan in order to open an account, which is required to stay in Japan with a period of stay of more than 3 months to have an address.

In other words, even if you come to Japan with a Temporary Visitor(tourists) visa, which allows you to stay in Japan for up to 90 days, you will not be able to open a bank account.

From this information only, some people may think that if they do not have a bank account in Japan, they cannot establish a company in Japan.

However, even in such a situation, there is still a way to establish a company.

Below is a list of bankbook account holders who can pay the investment when establishing a company.

1 Founder

2 Directors at incorporation

* Delegation of authority to receive payments by the founder is required.

3. If none of the founders and directors at incorporation have domiciles in Japan = Third party

* Delegation of authority to receive payments by the founder is required.

It should be noted that the founders can use not only their own bank accounts, but also the bank accounts of the initial directors and third parties.

In other words, a foreign entrepreneur living overseas who does not have a bank account in Japan will practically establish a company together with a “cooperator residing in Japan” who has a bank account in Japan.

If there is a founder residing in Japan as a co-founder, it is possible to use that person’s bank account.

However, when establishing a stock company, there is a rule that “the founder must contribute a part of the investment”, If you become a promoter as a cooperator, please note that the cooperator must also contribute money.

In addition, in order for foreigners living abroad to establish a company and obtain a Business Manager visa, to secure a business office, which is a requirement for a Business Manager visa, also, in order to apply for a Business Manager visa on your behalf, you will need a “cooperator residing in Japan”.

In this way, foreign investors residing overseas need a “cooperator residing in Japan” not only to establish a company but also to obtain a Business Manager visa.

③ What documents do you need for Chinese entrepreneurs in China to establish a stock company?

The seal registration certificate required to establish a stock company can only be obtained by a person who has been granted a period of stay of more than 3 months and has an address in Japan.

In addition, in many cases, a “cooperator residing in Japan”, which is necessary for foreign entrepreneurs living overseas, will be the representative director of the stock company to be established.

Therefore, when a Chinese entrepreneur Mr. A in China establishes a company as a joint representative director with a cooperator Mr. B in Japan, the main required documents are as follows.

2 Articles of Incorporation

3 Seal registration form and Mr. A’s seal notarization

4 A copy of the personal account of the cooperator who paid the investment

5 Notarized seal of Mr. A who will be the founder

6 Consent letter of appointment of Mr. A who will be the representative director

Letter of consent from Mr. B who will become the representative director

7 Notarized seal of Mr. A, who will be the representative director

Seal registration certificate of Mr. B who will be the representative director

In this way, Mr. A, a Chinese entrepreneur, needs a seal notarization certificate instead of a seal registration certificate.

④ What documents do you need for foreign entrepreneurs in other countries?

Basically, it is the same as the case of ③, but instead of the seal registration certificate, you will prepare a signature certificate (signature certificate).

A signature certificate is a certificate issued by the authorities of the home country to prove that the signature belongs to the individual.

For example, in the case of a Vietnamese living in Vietnam, the one prepared by the Vietnamese government, and in the case of a Vietnamese living in China, the one prepared by the Vietnamese Embassy in China.

Regarding the fact that the signature of a Vietnamese person residing in China is that of the person himself/herself, even a certificate prepared by the Chinese government or a notary public in China may be accepted as a signature certificate. It is better to avoid it as it runs the risk of not being accepted.

4. Summary of how to establish a company in Japan

Among various options, it is necessary to judge whether to establish a company, and what kind of company form to choose if it is established, after accurately grasping the advantages and disadvantages.

In addition, foreign entrepreneurs who wish to obtain a Business Manager visa have more considerations than Japanese entrepreneurs, as explained on this page.

Read this page and start preparing with the right knowledge.

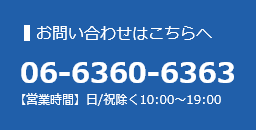

An Administrative Scrivener Corporation Daiichi Sogo Office provides consultations for foreigners regarding company establishment and application for a Business Manager visa to the Immigration Bureau at any time.

We also support English, Chinese, and Vietnamese, so please feel free to contact us.