Points of application for change from a business manager visa to a permanent resident visa

The purpose of business manager visa is to enable foreigners to engage in business management in Japan. You will be able to engaged in business more stably and continuously by obtaining a permanent resident visa, so obtaining a permanent resident visa can be very advantageous.

In this article, we focus on points of application for change from a business manager visa to a permanent resident visa.

Index

1. Director’s fees

In order to obtain a permanent resident visa, “the Foreign National must have sufficient assets or skills to make an independent living” (Article 22, paragraph 2, item (2) of the Immigration Act. The requirement for independent living). The number of people in the applicant’s household and the total income of the entire household, area of residence, ages of members in the household, etc. are considered comprehensively to check if the applicant will continue to have a stable living situation.

There is no clear standard, but at least 3,000,000 yen is said to be required to change from a work visa to a permanent resident visa. For company managers, director’s fees are the source of applicant’s income, so it is favorable to set the amount of director’s fees higher than 3,000,000 yen (i.e. more than 250,000 yen per month).

Please note that director’s fees can only be changed within 3 month from the first day of every business year.

Additionally, since July 2019, income certificates for the last 5 years have been required to be submitted when applying for a permanent resident visa. It depends on the company’s situation of the settlement of accounts, but if you plan to obtain a permanent resident visa eventually, it is recommendable to keep the director’s fees higher than 3,000,000 yen per year starting from at least 5 years before the time when you become eligible to apply for a permanent resident visa (Principally, after residence for 10 year or more, plus 5 years or more since the date of obtaining a work visa or residence qualification).

2. Stability and continuity of a company

Each company has a legal personality, and managers are not equivalent to their companies in the eye of the law. Therefore, you may think the financial situation of his/her company should not matter when a manager applies for a permanent resident visa. Nevertheless, director’s fees for a manager are usually affected by the financial status of the company. If the financial status of the company becomes worse, director’s fees may be reduced to make up the deficit, or directors can even be dismissed in the worst case scenario.

Therefore, in case of applying to change from a business manager visa to a permanent resident visa, the stability and continuity of the company managed by the applicant are examined as a part of checking whether the applicant can secure stable income.

When a company is in the state of insolvency (i.e. more debts than assets), it cannot be said that the manager who is applying for a visa secures stable income. Moreover, when a company is not in the state of insolvency, but has a series of losses, it is highly possible that director’s fees will be reduced, so such situation is also considered to be an issue in light of securing stable income. It is preferable that current profit is in the black for the last 2 business years.

3. Situation of company’s payment of tax

Not only the situation of tax payment by an applicant who is a manager, but also the situation of tax payment by his/her company will be subject to examination for permanent resident visa. Among others, the subscription of social insurance and payment of social insurance premiums are strictly checked in recent years.

Companies are deemed to be the workplaces covered by social insurance (employees’ pension insurance and health insurance), and even 1-person company without directors must subscribe social insurance. Also, the payment of social insurance premiums is divided fifty-fifty between the employee and the employer, so company must bear half of the premiums.

When a manager is applying for a permanent resident visa, a certificate of payment of social insurance premiums issued by a pension office must be submitted. If the manager does not subscribe any social insurance or haven’t paid any social insurance premiums or is behind in the payment of such premiums, such facts will affect the examination concerning a permanent resident visa very negatively. Please make sure to subscribe social insurance, and correctly pay social insurance premiums.

4. Number of days spent outside of Japan

Among foreigners managing company in Japan, there are many people who conducts business in other countries and work globally. They tend to spend many days outside of Japan.

In case of application for a permanent resident visa, the situations of departures from Japan are subject to examination. If the applicant is considered not to have a base for activity in Japan, judging from the frequency and number of days of such departures, permanent residence will not be granted. If the applicant is outside of Japan for half a year (i.e. 183 days) or more, the chances to receive permanent residence becomes very low.

However, if the reason of leaving Japan is reasonable and frequency of departure and length of time spent outside of Japan are considered adequate, the applicant may be evaluated as being based in Japan for his/her activities even if many days are spent outside of Japan. If you have many business trips to foreign countries, we recommend you to demonstrate the details of business activities abroad and the reasons of departure, as well as that foundation of business activities is in Japan (e.g. the headquarter and main function are concentrated in Japan).

5. Summary of points of application for change from a business manager visa to a permanent resident visa

When applying to change from a business manager visa to a permanent resident visa, more items are examined comparing to other types of status of residence, but as long as the company is managed in an appropriate manner and a profiting system is constructed, there is nothing to be afraid of.

It is nerve-racking to conduct business in a foreign country. It is very natural for foreign managers to hope to engage in business with a feeling of safety.

Daiichi-Sogo Group does not only support application for a permanent resident visa, but support clients with full force from all directions, so foreign managers can engage in business with a feeling of safety.

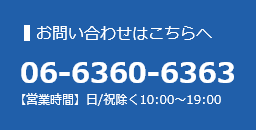

If you have a business manager visa and are considering to apply for a permanent resident visa, please feel free to contact us.