【From 2025.10.16】Tougher criteria for the “Business Manager” status of residence! Capital raised to 30 million yen — Explained by a Gyoseishoshi (Administrative Scrivener)

The permission criteria for the status of residence “Business Manager” (経営・管理, commonly called the Business Manager visa), which foreign nationals need to run a business in Japan, will change as of October 16, 2025!

How do the new criteria differ from the old? What happens if you already hold a Business Manager visa? Do applicants currently under review need to reapply? A visa-specialist Gyoseishoshi answers these and other common questions in one place. If you want the latest information on the Business Manager visa, please read to the end.

Immigration Services Agency website:

Revision of the Ministerial Ordinance on Landing Standards for the Status of Residence “Business Manager”

Index

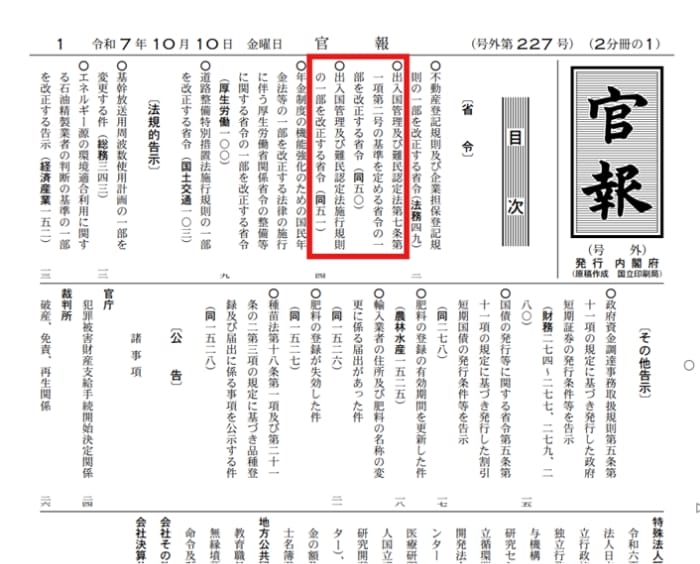

1. The revision to the Business Manager visa permission criteria has been promulgated!

News reports and newspapers have long covered the tightening of the “Business Manager” visa requirements. The amendment to the Ministry of Justice ministerial ordinance that defines the permission criteria for the Business Manager visa was promulgated on October 10, 2025.

Along with this amendment, the required documents and examination procedures will also change.

In this article, we will provide a comprehensive explanation not only of the contents of the amended ordinance itself, but also of the related changes that will result from it.

2. Four key points in the revised criteria

Let’s dive right into what has changed. There are four major points. First, review the outline in a comparison with the current criteria.

| Current permission criteria | New permission criteria | |

| ① Paid-up capital (amount of capital) | 5 million yen | 30 million yen |

| ② Experience / academic background (for the manager) | None | At least 3 years’ experience in management/administration or A master’s-equivalent or higher degree related to business management or to the field of the business to be managed |

| ③ Hiring obligation | None | Employ at least one full-time employee |

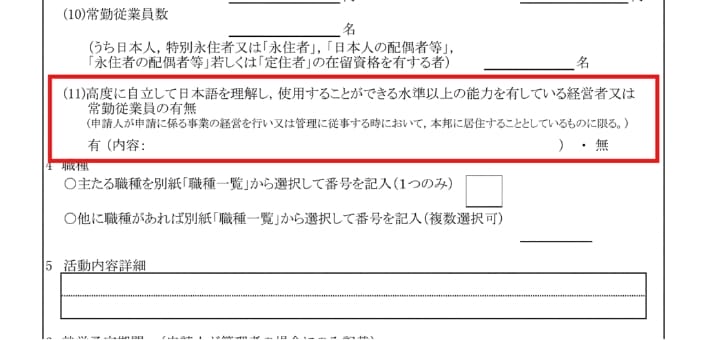

| ④ Japanese-language ability | None | The applicant or a full-time employee must have a considerable level of Japanese ability. |

Let’s look at each of the four points in detail.

① Paid-in capital must be at least 30 million yen!

The capital requirement is being raised substantially to at least 30 million yen.

[After revision] At least 30 million yen required

For a stock company (Kabushiki-gaisha), this refers to paid-up capital; for a GK (Gōdō-gaisha) or unlimited/limited partnership (Gōmei/Gōshi-gaisha), it refers to total investment.

For a sole proprietor, it refers to the total spent on items necessary to run the business—securing a place of business, salaries of employed staff (for one year), capital expenditures, etc. Note that incorporating is not mandatory. As before, you can obtain a Business Manager visa as a sole proprietor.

② Three or more years’ experience or a master’s degree or higher is required!

This requirement did not exist before; it is newly added.

[After revision] You must meet one of A–C below:

A: At least three years of experience in business management/administration

B: A doctoral, master’s, or professional degree related to business management

C: A doctoral, master’s, or professional degree related to the field of the business you will operate

For item A (experience), periods in Japan under “Designated Activities” status obtained for pre-application preparation for the Business Manager visa may be counted. For B and C (degrees), degrees obtained outside Japan are also acceptable. You only need to meet one of A–C, so in practice you either apply after obtaining the degree or after accumulating three years of practical experience.

③ Hiring at least one full-time employee is required!

Until now, permission could be granted with 5 million yen in capital even with no employees. Under the revision, regardless of capital, you are required to hire one “full-time employee.”

[After revision] Employ at least one full-time employee who is either:

A: A Japanese national,

B: A foreign national holding one of: “Permanent Resident,” “Spouse or Child of Japanese National,” “Spouse or Child of Permanent Resident,” or “Long-Term Resident.”

C: A Special Permanent Resident

Only Japanese nationals, foreign nationals holding a status based on personal status or relationship, or Special Permanent Residents qualify as “full-time employees.” You are free to employ foreign nationals with other statuses (e.g., “Engineer/Specialist in Humanities/International Services,” “Specified Skilled Worker”), but they do not count toward the “full-time employee” requirement for Business Manager permission. Also, “full-time” is required—this must be a full-time position.

④ Japanese-language ability is required!

Previously there was no standard for Japanese ability, and even applicants with no Japanese at all could obtain the Business Manager visa. Under the revision, either the applicant or one full-time employee must have Japanese-language ability.

[After revision] Either the applicant or a full-time employee must have a considerable level of Japanese ability.

Here, “full-time employee” may be Japanese or foreign; if foreign, any status is acceptable—there is no limitation like in (③) above. However, the person must either already reside in Japan or be scheduled to reside in Japan. Hiring a “Japanese-speaking staff member who lives overseas” as a full-time employee does not satisfy the requirement, so please take care.

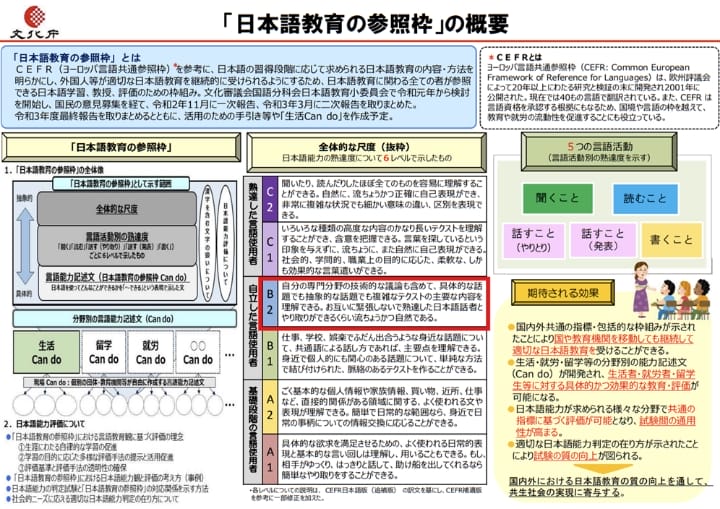

“Considerable Japanese ability” refers to level B2 or higher in the Agency for Cultural Affairs’ “Japanese Language Education Reference Framework.”

Concretely, satisfying any one of A–E below will be deemed to constitute “considerable Japanese ability”:

- A: JLPT (Japanese-Language Proficiency Test) N2 or higher

- B: BJT Business Japanese Proficiency Test score of 400 or higher

- C: 20 years or more of residence in Japan as a mid- to long-term resident

- D: Graduation from a Japanese university or other higher education institution

- E: Completion of compulsory education in Japan and graduation from a Japanese high school

Note that the “full-time employee” required under the hiring obligation (③) does not have a Japanese-ability requirement; they need not speak Japanese. However, if the applicant cannot speak Japanese either, you will need to hire an additional full-time employee who does meet the Japanese-ability requirement.

3. Four Other Important Changes to Note

Along with the revision of the permission criteria, some aspects of administrative operation and examination procedures will also change.

Among them, there are four points that require particular attention.

① Prior confirmation of your business plan is required!

② Using your home as an office is, in principle, no longer allowed!

③ You cannot renew your visa if you have been abroad for an extended period!

④ Check what obligations you must fulfill as a business owner!

Let’s go through each of these in detail.

① Prior confirmation of your business plan is required!

In the past, there were cases where applicants were asked to prepare and submit a business plan. Under the new rules, however, the contents of the prepared business plan must now be confirmed in advance by a qualified management professional.

[After revision] Confirmation by one of the following professionals (A–C) is required:

A: Small and Medium Enterprise Management Consultant (中小企業診断士)

B: Certified Public Accountant (公認会計士)

C: Licensed Tax Accountant (税理士)

Specific details on how this confirmation will be conducted will be clarified in guidelines to be released in the future.

② Using your home as an office is, in principle, no longer allowed!

With this amendment, the requirements regarding “office premises” have also been made more stringent.

Previously, if the applicant was running a business alone, it was permissible to use a home office—as long as the residential and office spaces were clearly separated in the floor plan.

After this revision, such arrangements will in principle no longer be accepted, and applicants will be required to secure an office separate from their residence.

[After revision] In principle, not permitted

Since applicants will now need to secure two separate properties—one for residence and one for office use,this requirement will become a significant hurdle for many business operators.

③ You cannot renew your visa if you have been abroad for an extended period!

If you stay outside Japan for a long period without a valid reason during your period of stay, immigration authorities may determine that you have not been actually engaging in business activities in Japan.

In such a case, your visa renewal application will not be approved.

If you had to remain abroad for a long time due to unavoidable or legitimate circumstances, you must submit a written statement explaining the reasons and provide detailed information about the situation.

④ Check what obligations you must fulfill as a business owner!

Once you become a business owner in Japan, you must handle a variety of legal procedures not only for taxation, but also under the labor insurance and social insurance systems. Under the latest revision, immigration authorities will now also check whether these legal obligations have been properly fulfilled.

(1) Labor insurance coverage status

・ Proper acquisition of employment insurance coverage for eligible employees

・ Proper payment of employment insurance premiums

・ Status of procedures for workers’ accident compensation insurance

(2) Social insurance coverage status

・ Proper acquisition of health insurance and employees’ pension insurance coverage

・ Proper payment of the corresponding social insurance premiums

(3) Status of payment of national and local taxes that must be paid by the business entity

■For corporations:

National taxes: withholding income tax and special reconstruction income tax, corporation tax, consumption tax and local consumption tax

Local taxes: corporate inhabitant tax, enterprise tax

■For sole proprietors:

National taxes: withholding income tax and special reconstruction income tax, income tax and special reconstruction income tax, consumption tax and local consumption tax, inheritance tax, gift tax

Local taxes: individual inhabitant tax, individual business tax

Procedures for labor insurance and social insurance involve many technical terms and can be difficult for those handling them for the first time. To ensure all procedures are completed accurately and without omissions, it is recommended to seek support from a licensed labor and social security attorney (Shakai Hoken Rōmushi, or “Sharoushi”).

At Daiichi Sogo Group, we also have a Sharoushi Corporation within our organization. We provide support services tailored for foreign business owners, so please feel free to take advantage of our free consultation.

[Visit the website of Daiichi Sogo Labor and Social Security Attorney Office here]

In addition, for businesses that require licenses or permits—such as restaurants or transport companies—documents proving that the necessary permissions have been obtained (e.g., a copy of the license certificate) must also be submitted.

4. The new criteria apply from October 16, 2025

The revised criteria will apply to applications received on or after Thursday, October 16, 2025.

The application form will also change

The application form for the Business Manager visa (including “Highly Skilled Professional (i) (ha)”) will also be updated in line with this revision. New items—such as those on Japanese-language ability—will be added.

What if you already hold a Business Manager visa?

Those who already hold a Business Manager visa will also be subject to the new criteria at their next renewal. However, for those filing a renewal within the next three years (up to October 16, 2028), even if some aspects do not conform to the new criteria at the time of application, it appears that authorities will assess flexibly—for example, taking into account the business’s track record to date or the prospect of conforming after renewal.

What if you are applying now and your result is still pending?

For applications received by Wednesday, October 15, 2025 (the day before the effective date), the pre-revision criteria will apply. If your review result is pending, wait for the outcome for now.

What if you want to change from “J-Find Future-Creation Talent” (Designated Activities No. 51)?

There is a “Designated Activities No. 51” status that allows outstanding graduates of overseas universities, etc., to conduct business-startup preparation in Japan. If you switch from that (No. 51) to the Business Manager visa, the pre-revision criteria will apply.

① You hold Designated Activities No. 51 by October 15, 2025

or

② You have applied for issuance/change to Designated Activities No. 51 by October 15, 2025 and are awaiting the result.

5. For those who want to reliably obtain/renew the Business Manager visa

In this article we explained the revision to the Business Manager permission criteria based on the government’s published materials. That said, some points remain unclear in the published documents alone. We will proactively seek clarification—e.g., by inquiring with the screening divisions—and deliver updated explanatory columns as soon as new information is released!

With this revision, requirements have become stricter, and the preparations needed to obtain the Business Manager visa have increased significantly. Moreover, details on some finer points are still forthcoming. If you want to be sure of obtaining or renewing a Business Manager visa, please seek support from a specialist. Ideally, choose an expert who keeps up with the latest information on the Immigration Control Act and visas on a routine basis.

We at Daiichi Sogo Office are a rare administrative scrivener corporation in Japan specializing in visa applications. We will do our utmost to ensure your business can continue in Japan for the long term. Your first consultation is free. If you have any concerns or questions, please feel free to call us.